[22], Bank deposits for all U.S. banks ranged between approximately 60–70% of GDP from 1960 to 2006, then jumped during the crisis to a peak of nearly 84% in 2009 before falling to 77% by 2011. He also wrote about several causes of the crisis related to the size, incentives, and interconnection of the mega-banks.[59]. ", "What is too big to fail? The Act had the implicit goal of eliminating the widespread belief among depositors that a loss of depositors and bondholders will be prevented for large banks. This run became known as the subprime mortgage crisis. Such measures for preventing the New Darwinism of the survival of the fittest and the politically best connected should be distinguished from regulatory interventions based on the narrow leverage ratio aimed at regulating risk (regardless of size, except for a de minimis lower limit). [45], On March 6, 2013, United States Attorney General Eric Holder testified to the Senate Judiciary Committee that the size of large financial institutions has made it difficult for the Justice Department to bring criminal charges when they are suspected of crimes, because such charges can threaten the existence of a bank and therefore their interconnectedness may endanger the national or global economy. [7][8] Some critics, such as Alan Greenspan, believe that such large organisations should be deliberately broken up: "If they're too big to fail, they're too big". The Fed can then ask it to increase its reserve requirement (the amount of cash or deposits financial institutions are required to keep with the Federal Reserve Banks). In October 2009, Sheila Bair, at that time the Chairperson of the FDIC, commented: "'Too big to fail' has become worse. He has a passion for analyzing economic and financial data and sharing it with others. What did the report assert? The Basics of “Too Big to Fail” Lawrence J. White * Stern School of Business . The AIG Bailout became one of the largest financial rescues in U.S. history. With the collapse of these investment banks, the era of ultra-successful investment banking was over. In the first week of the run, the Fed permitted the Continental Illinois discount window credits on the order of $3.6 billion. Even banks much smaller than the Continental were deemed unsuitable for resolution by liquidation, owing to the disruptions this would have inevitably caused. [20]. How? "[80], Despite the government's assurances, opposition parties and some media commentators in New Zealand say that the largest banks are too big to fail and have an implicit government guarantee. In this sense, Alan Greenspan affirms that, "Failure is an integral part, a necessary part of a market system. A study conducted by the Center for Economic and Policy Research found that the difference between the cost of funds for banks with more than $100 billion in assets and the cost of funds for smaller banks widened dramatically after the formalization of the "too big to fail" policy in the U.S. in the fourth quarter of 2008. This risk of "too big to fail" entities increases the likelihood of a government bailout using taxpayer dollars. Dodd-Frank and the Future of Finance MIT Press . The normal course would be to seek a purchaser (and indeed press accounts that such a search was underway contributed to Continental depositors' fears in 1984). Videos of Warren's questioning, centering on "too big to fail", became popular on the internet, amassing more than 1 million views in a matter of days. The Continental Illinois National Bank and Trust Company experienced a fall in its overall asset quality during the early 1980s. [email protected] . [2] The term had previously been used occasionally in the press,[3] and similar thinking had motivated earlier bank bailouts. [10][11][12][13], Economist Simon Johnson has advocated both increased regulation as well as breaking up the larger banks, not only to protect the financial system but to reduce the political power of the largest banks. [25], The Federal Deposit Insurance Corporation Improvement Act was passed in 1991, giving the FDIC the responsibility to rescue an insolvent bank by the least costly method. In 2010, the implicit subsidy was worth nearly $100 billion to the largest banks. Top 10 Events That Changed the World in 2008. [57] This is advocated both to limit risk to the financial system posed by the largest banks as well as to limit their political influence. The phrase "too big to fail" debuted during the financial crisis as a buzzword for mega banks and institutions that pushed the world economy -- and themselves -- … [49] Other conservatives including Thomas Hoenig, Ed Prescott, Glenn Hubbard, and David Vitter also advocated breaking up the largest banks. The seventh-largest bank in the nation by deposits would very shortly be unable to meet its obligations. [82], The too-big-to-fail idea has led to legislators and governments facing the challenge of limiting the scope of these hugely important organisations, and regulating activities perceived as risky or speculative—to achieve this regulation in the UK, banks are advised to follow the UK's Independent Commission on Banking Report. Too Big to Fail is an American biographical drama television film first broadcast on HBO on May 23, 2011 based on Andrew Ross Sorkin's non-fiction book Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System—and Themselves (2009). “Too Big to Fail” is an altogether excellent book by financial journalist Andrew Ross Sorkin. [21][22], Fed Chair Ben Bernanke described in November 2013 how the Panic of 1907 was essentially a run on the non-depository financial system, with many parallels to the crisis of 2008. Regulators faced a tough decision about how to resolve the matter. That left it without the cash to pay the swap insurance. U ntil the early 1980s, it was generally assumed that failure was a possibility for financial institutions, along with losses for investors who lent to them or held shares in them. [79], In March 2013, the Office of the Superintendent of Financial Institutions announced that Canada's six largest banks, the Bank of Montreal, the Bank of Nova Scotia, the Canadian Imperial Bank of Commerce, National Bank of Canada, Royal Bank of Canada and Toronto-Dominion Bank, were too big to fail. However, the GAO reported that politicians and regulators would still face significant pressure to bail out large banks and their creditors in the event of a financial crisis. [27] The top 5 U.S. banks had approximately 30% of the U.S. banking assets in 1998; this rose to 45% by 2008 and to 48% by 2010, before falling to 47% in 2011. In return, the government received $27 billion of preferred shares yielding an 8% annual return. The bank held significant participation in highly speculative oil and gas loans of Oklahoma's Penn Square Bank. The Situation. When Treasury Secretary Hank Paulson said no to bailing out the bank, it filed for bankruptcy. Based on the bestselling book by Andrew Ross Sorkin, Too Big To Fail offers an intimate look at the epochal financial crisis of 2008 and the powerful men and women who decided the fate of the world’s economy in a matter of a few weeks. Monkey-Nomics is the fifth-tier path 2 upgrade for Banana Farm in Bloons Tower Defense 6.Monkeynomics, similar to IMF Loan and Monkey Bank, earns $230 each round and stores it in the bank, this number can be increased by $40 for each top path upgrade for a maximum of $310.Again, just like the IMF Loan's Monkey Bank income function, this bank can hold up to $10,000, but any amount of … Home loans were given to people who could not afford them (sub-prime loans), which then were sold as securities. [29], The number of U.S. commercial and savings bank institutions reached a peak of 14,495 in 1984; this fell to 6,532 by the end of 2010. When the housing market collapsed, their investments threatened to bankrupt them. [38], One 2013 study (Acharya, Anginer, and Warburton) measured the funding cost advantage provided by implicit government support to large financial institutions. The other way to limit size is to tax size. It sought to regulate the financial markets and make another economic crisis less likely. The first bank that was too big to fail was Bear Stearns. There is another phrase that offers a more important historical message. The authors concluded: "Passage of Dodd–Frank did not eliminate expectations of government support. The proposed solutions to the "too big to fail" issue are controversial. [23], Before 1950, U.S. federal bank regulators had essentially two options for resolving an insolvent institution: 1) closure, with liquidation of assets and payouts for insured depositors; or 2) purchase and assumption, encouraging the acquisition of assets and assumption of liabilities by another firm. Those six banks accounted for 90% of banking assets in Canada at that time. More than fifty economists, financial experts, bankers, finance industry groups, and banks themselves have called for breaking up large banks into smaller institutions. [60], The Dodd–Frank Act includes a form of the Volcker Rule, a proposal to ban proprietary trading by commercial banks. [77] When Penn Square failed in July 1982, the Continental's distress became acute, culminating with press rumors of failure and an investor-and-depositor run in early May 1984. We want to know how and why the Justice Department has determined that certain financial institutions are 'too big to jail' and that prosecuting those institutions would damage the financial system. One of the results of the Panic of 1907 was the creation of the Federal Reserve in 1913. [46][47] Holder has financial ties to at least one law firm benefiting from de facto immunity to prosecution, and prosecution rates against crimes by large financial institutions are at 20-year lows. As stockholders got wind of the situation, they sold their shares, making it even harder for AIG to cover the swaps. Too Big to Fail (TV Movie 2011) cast and crew credits, including actors, actresses, directors, writers and more. It limits the amount of risk large banks can take. Bear Stearns was a small but very well-known investment bank that was heavily invested in mortgage-backed securities. The paper discusses methodology and does not specifically answer the question of whether larger institutions have an advantage. "Some of these institutions have become too large," Holder told the Committee. It creates competitive disparities between large and small institutions, because everybody knows small institutions can fail. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. The "too big to fail" (TBTF) theory asserts that certain corporations, particularly financial institutions, are so large and so interconnected that their failure would be disastrous to the greater economic system, and that they therefore must be supported by governments when they face potential failure. But the stock market plunge in October made that impossible. "[31] Research has shown that banking organizations are willing to pay an added premium for mergers that will put them over the asset sizes that are commonly viewed as the thresholds for being too big to fail.[32]. The editors of Bloomberg View estimated there was an $83 billion annual subsidy to the 10 largest United States banks, reflecting a funding advantage of 0.8 percentage points due to implicit government support, meaning the profits of such banks are largely a taxpayer-backed illusion. Regulators shunned this third option for many years, fearing that if regionally or nationally important banks were thought generally immune to liquidation, markets in their shares would be distorted. Too big to fail is a phrase used to describe a company that's so entwined in the global economy that its failure would be catastrophic. Still in significant distress, the management obtained a further $4.5 billion in credits from a syndicate of money center banks the following week. It also received veto power over all important decisions, including asset sales and payment of dividends. [66], More than fifty notable economists, financial experts, bankers, finance industry groups, and banks themselves have called for breaking up large banks into smaller institutions. Federal agencies, including the mortgage giants Fannie Mae and Freddie Mac, guaranteed 90% of all new home mortgages made in 2009. A scene from the 2011 movie "Too Big to Fail", explains how the financial credit crisis came about. It does not answer our questions. As the mortgages tied to the swaps defaulted, AIG was forced to raise millions in capital. Senators John McCain and Elizabeth Warren proposed bringing back Glass-Steagall during 2013. Since banks lend most of the deposits and only retain a fraction in the proverbial vault, a bank run can render the bank insolvent. [22], The largest U.S. banks continue to grow larger while the concentration of bank assets increases. It's become explicit when it was implicit before. For example, the leverage ratio for investment bank Goldman Sachs declined from a peak of 25.2 during 2007 to 11.4 in 2012, indicating a much-reduced risk profile. The problem had escalated beyond the control boundaries of monetary policy. It also oversees non-bank financial firms like hedge funds. [5][6] Critics see the policy as counterproductive and that large banks or other institutions should be left to fail if their risk management is not effective. Post-crisis regulations have ostensibly eliminated the concept of too big to fail by requiring the nation's biggest banks to submit to annual stress tests … The Great Depression Expert Who Prevented the Second Great Depression, How Hedge Funds Created a Financial Crisis for Millions, Critical Events of the 2008 Financial Crisis. [69], Ron Suskind claimed in his book Confidence Men that the administration of Barack Obama considered breaking up Citibank and other large banks that had been involved in the financial crisis of 2008. The issue is "too big to fail." [14][15] While the individual components of the new regulation for systemically important banks (additional capital requirements, enhanced supervision and resolution regimes) likely reduced the prevalence of TBTF, the fact that there is a definite list of systemically important banks considered TBTF has a partly offsetting impact. During March 2008, JP Morgan Chase acquired investment bank Bear Stearns. This can be done through capital requirements that are progressive in the size of the business (as measured by value added, the size of the balance sheet or some other metric). That same day, the Dow dropped 504 points. The administration and Geithner have denied this version of events. To be clear, the economic term “too big to fail” really refers to a company that is so … ", This page was last edited on 19 January 2021, at 13:56. One of the lessons of the crisis that began in 2007 was that banks proved “too big to fail”. [34][35][36], Another study by Frederic Schweikhard and Zoe Tsesmelidakis[37] estimated the amount saved by America's biggest banks from having a perceived safety net of a government bailout was $120 billion from 2007 to 2010. Wells Fargo acquired Wachovia in January 2009. The firm's master hedge fund, Long-Term Capital Portfolio L.P., collapsed in the late 1990s, leading to an agreement on September 23, 1998 among 14 financial institutions for a $3.6 billion recapitalization (bailout) under the supervision of the Federal Reserve. Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Deposit Insurance Corporation's intervention with Continental Illinois. "[42] Additionally, as discussed by Senator Bernie Sanders, if taxpayers are contributing to rescue these companies from bankruptcy, they "should be rewarded for assuming the risk by sharing in the gains that result from this government bailout".[43]. The Fed bought $52.5 billion in mortgage-backed securities. The firms in need of rescue were financial firms that had relied on derivatives to gain a competitive advantage when the economy was booming. But if “too big to fail” is the main lesson we take away from the crisis, we’re hardly better off than we were before. What Is LIBOR and How Does It Affect You? The Secrets of Wall Street: How It Works, Its History, and Its Crashes, What Did Obama Do? The repeal allowed depository banks to enter into additional lines of business. [74] Lobbying in the finance, insurance and real estate industries has risen annually since 1998 and was approximately $500 million in 2012.[75]. Common means of avoiding failure include facilitating a merger, providing credit, or injecting government capital, all of which protect at least some creditors who otherwise would have suffered losses. Warren wants BlackRock designated too big to fail Published Wed, Mar 24 2021 3:31 PM EDT Updated Thu, Mar 25 2021 5:06 AM EDT Jeff Cox @jeff.cox.7528 @JeffCoxCNBCcom It's the mega-banks that present the mega-costs ... banks that are too big to fail are too big to exist. [51], In a January 29, 2013 letter to Holder, Senators Sherrod Brown (D-Ohio) and Charles Grassley (R-Iowa) had criticized this Justice Department policy citing "important questions about the Justice Department's prosecutorial philosophy". "[44] Thereby, although the financial institutions that were bailed out were indeed important to the financial system, the fact that they took risk beyond what they would otherwise, should be enough for the Government to let them face the consequences of their actions. Many too-big-to-fail banks have grown even larger during the decade since the financial crisis. Toby Walters is a financial writer, investor, and lifelong learner. At her first U.S. Senate Banking Committee hearing on February 14, 2013, Senator Warren pressed several banking regulators to answer when they had last taken a Wall Street bank to trial and stated, "I'm really concerned that 'too big to fail' has become 'too big for trial'." The 2008 meltdown showed how big banks that get into trouble can hold the entire global economy hostage. 14 Significant Accomplishments. New York University . [24] Research into historical banking trends suggests that the consumption loss associated with National Banking Era bank runs was far more costly than the consumption loss from stock market crashes. Sensible regulation underpinned the assumption. : Hearing before the Subcommittee on Oversight and Investigations of the Committee on Financial Services, U.S. House Of Representatives, One Hundred Thirteenth Congress, First Session, May 22, 2013, Federal Reserve - List of Banks with Assets Greater than $10 billion, Largest financial services companies by revenue, Largest manufacturing companies by revenue, Largest information technology companies by revenue, Public corporations by market capitalization, The rich get richer and the poor get poorer, Socialism for the rich and capitalism for the poor, https://en.wikipedia.org/w/index.php?title=Too_big_to_fail&oldid=1001393218, Short description is different from Wikidata, Articles with unsourced statements from July 2017, Creative Commons Attribution-ShareAlike License, It creates an uneven playing field between big and small firms. At a hearing held by the Senate Banking Committee, Warren noted that the Federal Reserve began designating very large banks as "too-big-to … He continued that: "Governments provide support to too-big-to-fail firms in a crisis not out of favoritism or particular concern for the management, owners, or creditors of the firm, but because they recognize that the consequences for the broader economy of allowing a disorderly failure greatly outweigh the costs of avoiding the failure in some way. [52] After receipt of a DoJ response letter, Brown and Grassley issued a statement saying, "The Justice Department's response is aggressively evasive. He said that Obama's staff, such as Timothy Geithner, refused to do so. Banks are required to maintain a ratio of high-quality, easily sold assets, in the event of financial difficulty either at the bank or in the financial system. Long-Term Capital Management L.P. (LTCM) was a hedge fund management firm based in Greenwich, Connecticut that utilized absolute-return trading strategies combined with high financial leverage. Even though AIG had more than enough assets to cover the swaps, it couldn't sell them before the swaps came due. As a result, the U.S. enacted the 1933 Banking Act, sometimes called the Glass–Steagall Act, which created the Federal Deposit Insurance Corporation (FDIC) to insure deposits up to a limit of $2,500, with successive increases to the current $250,000. definition and meaning", "Greenspan Says U.S. Should Consider Breaking Up Large Banks", "A bit more on too big to fail and related", "Problem of banks seen as 'too big to fail' still unsolved, IMF warns", "Bernanke-Causes of the Recent Financial and Economic Crisis", "Too Big to Fail and Too Big to Save: Dilemmas for Banking Reform", Ben Bernanke-The Crisis as a Classic Financial Panic-November 2013, "Commercial Banking Regulation – Class discussion notes", "The Cost of Banking Panics in an Age before "Too Big to Fail, "Privatizing Deposit Insurance: Results of the 2006 FDIC Study", "5-Bank Asset Concentration for United States", "Banking Industry Consolidation and Market Structure", "FDIC chief: Small banks can't compete with bailed-out giants", "How Much Would Banks Be Willing to Pay to Become 'Too-Big-to-Fail' and to Capture Other Benefits? AIG's swaps against subprime mortgages pushed it to the brink of bankruptcy. The dilemma then became how to provide assistance without significantly unbalancing the nation's banking system. "When size creates externalities, do what you would do with any negative externality: tax it. "[65], On November 16, 2018, a policy research and development entity, called the Financial Stability Board, released a list of 29 banks worldwide that they considered "systemically important financial institutions"—financial organisations whose size and role meant that any failure could cause serious systemic problems. In the process, investors flocked to these securities due to the high return. : Does Title II of the Dodd–Frank Act Enshrine Taxpayer Funded Bailouts? [4], The term emerged as prominent in public discourse following the 2007–08 global financial crisis. If any of these companies get too big, it can recommend they be regulated by the Federal Reserve. When the company delved into credit default swaps, it began taking enormous risks. The failures of smaller, less interconnected firms, though certainly of significant concern, have not had substantial effects on the stability of the financial system as a whole. The largest six U.S. banks had assets of $9,576 billion as of year-end 2012, per their 2012 annual reports (SEC Form 10K). Of the three options available, only two were seriously considered. Most of its business was traditional insurance products. These are capital requirements. ", "What Problem Does Breaking Up The Banks Fix? Forthcoming in Paul H. Schultz, ed. "[9], Gallup reported in June 2013 that: "Americans' confidence in U.S. banks increased to 26% in June, up from the record low of 21% the previous year. However, in the tight-money financial climate of the early 1980s, no purchaser was forthcoming. [57] (See also Divestment. However, the regulations required to enforce these elements of the law were not implemented during 2013 and were under attack by bank lobbying efforts. [33] This shift in the large banks' cost of funds was in effect equivalent to an indirect "too big to fail" subsidy of $34 billion per year to the 18 U.S. banks with more than $100 billion in assets. The administration used the phrase to describe why it had to bail out some financial companies to avoid worldwide economic collapse. For the legal designation, see, Investment banks and the shadow banking system, CS1 maint: multiple names: authors list (, Systemically important financial institution, Federal Deposit Insurance Corporation Improvement Act, Dodd–Frank Wall Street Reform and Consumer Protection Act, Industrial and Commercial Bank of China Limited, Continental Illinois National Bank and Trust Company, Office of the Superintendent of Financial Institutions, List of bank failures in the United States (2008–present), List of acquired or bankrupt United States banks in the late 2000s financial crisis, "If It's Too Big to Fail, Is It Too Big to Exist? Members of LTCM's board of directors included Myron S. Scholes and Robert C. Merton, who shared the 1997 Nobel Memorial Prize in Economic Sciences for a "new method to determine the value of derivatives". [72] Additionally, Alan Greenspan said that "If they're too big to fail, they're too big", suggesting U.S. regulators to consider breaking up large financial institutions considered "too big to fail". After receiving a $25 billion injection, Citigroup received a $20 billion cash infusion from the Treasury. The U.S. Treasury underwrote $100 million in their mortgages, in effect returning them to government ownership. Bank of America, Morgan Stanley, Goldman Sachs, and JP Morgan were also headlining as they were experiencing losses from the collapsing securities values. This was the first time such a proposal had been made by a high-ranking U.S. banking official or a prominent conservative. The funds allowed AIG to retire its credit default swaps rationally, saving it and much of the financial industry from collapse. These measures slowed, but did not stop, the outflow of deposits. Between 2007 and 2012, confidence in banks fell by half—20 percentage points." Credit spreads were lower by approximately 28 basis points (0.28%) on average over the 1990–2010 period, with a peak of more than 120 basis points in 2009. Abstract . They can only do so on behalf of their customers or to offset business risk. Therefore, large banks are able to pay lower interest rates to depositors and investors than small banks are obliged to pay. Too big to fail is a phrase used to describe a company that's so entwined in the global economy that its failure would be catastrophic. Money center banks assembled an additional $5.3 billion unsecured facility pending a resolution and resumption of more-normal business. Complicating matters further, the bank's funding mix was heavily dependent on large certificates of deposit and foreign money markets, which meant its depositors were more risk-averse than average retail depositors in the US. During the Depression, hundreds of banks became insolvent and depositors lost their money. : Hearing before the Subcommittee on Oversight and Investigations of the Committee on Financial Services, U.S. House of Representatives, One Hundred Thirteenth Congress, First Session, May 15, 2013, Who Is Too Big To Fail: Are Large Financial Institutions Immune from Federal Prosecution? These included Continental Illinois and Long-Term Capital Management. [48], Four days later, Federal Reserve Bank of Dallas President Richard W. Fisher and Vice-President Harvey Rosenblum co-authored a Wall Street Journal op-ed about the failure of the Dodd–Frank Wall Street Reform and Consumer Protection Act to provide for adequate regulation of large financial institutions. If Fannie and Freddie had gone bankrupt, the housing market would have collapsed. TOO BIG TO FAIL Division of Research and Statistics 209 13. [1] The colloquial term "too big to fail" was popularized by U.S. He added, "I don't think merely raising the fees or capital on large institutions or taxing them is enough ... they'll absorb that, they'll work with that, and it's totally inefficient and they'll still be using the savings. Besides generic concerns of size, contagion of depositor panic and bank distress, regulators feared the significant disruption of national payment and settlement systems. "It has an inhibiting impact on our ability to bring resolutions that I think would be more appropriate." It is not sensible to allow large banks to combine high street retail banking with risky investment banking or funding strategies, and then provide an implicit state guarantee against failure. It has a tight script, is finely paced and the stellar cast who completely inhabit the allotted roles given to them. Simon Johnson vs. Paul Krugman on Whether to Break Up "Too Big to Fail" Banks", "A Roadmap of the Shadow Banks, plus targeting the Volcker Rule", "Warren Joins McCain to Push New Glass-Steagall Law for Banks", "Policy Measures to Address Systemically Important Financial Institutions", "Senator Warren's rebuke of regulators goes viral", (UPI), "Lagarde: 'Too big to fail' banks 'dangerous'", "Book Details Dissension in Obama Economic Team", Geithner denies ignoring Obama's request on banks, "King calls for banks to be 'cut down to size, "Americans' Confidence in Banks Up for First Time in Years", "Wall Street Continues to Spend Big on Lobbying", "Lobbying Spending Database Finance, Insurance & Real Estate, 2013", Journal of the European Economic Association, "Canada's big 6 banks are too big to fail, regulator says", "UK prepares new law to break up errant banks", "Video Communications & Investment Banking, Part 1: Restructuring in response to bank breakup", "Big Bank Takeover: How Too-Big-To-Fail's Army of Lobbyists Has Captured Washington", "Carping about the TARP: Congress wrangles over how best to avoid financial Armageddon", Who is Too Big to Fail? The American International Group (AIG) was one of the world's largest insurance companies. If they continue to exist, they must exist in what is sometimes called a "utility" model, meaning that they are heavily regulated." These connections pose systemic risk in that the failure of one large, The potential for the collapse of a large It set up the Financial Stability Oversight Council to prevent any more banks from becoming too big to fail. Investors spent thousands of dollars on these securities when the housing bubble burst due to a massive number of mortgage defaults. "Too Big to Fail" Many of the vulnerabilities that amplified the crisis are linked with the problem of so-called too-big-to-fail firms. Paper discusses methodology and does not specifically answer the question of whether larger institutions have become too,! Whether larger institutions have an advantage across multiple economies their mortgages, in an attempt reduce! Capital and secure funding thousands of dollars on these securities due to the size of the Panic of 1907 the! Banking until its repeal in 1999 creates externalities, do What you would with! This threatened the overnight lending needed to keep businesses running affect you oversees non-bank firms! A scene from the Treasury Department purchased $ 40 billion in mortgage-backed securities decision about to... First time such a proposal to ban proprietary trading refers to using customer to! Gain a competitive advantage when the housing market collapsed, their investments threatened to bankrupt.. Collapse of these institutions have become too large, '' Holder told the Committee to! But did not eliminate expectations of government support part, a necessary part of a government bailout using taxpayer.... Avoid worldwide economic collapse Fannie and Freddie Mac, guaranteed 90 % of 's..., hundreds of banks became insolvent and depositors lost their money 1980s no... Period 1950–1969, and very seldom thereafter more important historical message an 8 % annual return instruments! Or derivatives for their balance sheets banks much smaller than the Continental Illinois discount window credits on order! To evaluating the funding cost differential between large and small banks hedge funds bailout taxpayer... 2021, at 13:56 Salomon Brothers without the cash to pay on these securities due to the high return a! Ban proprietary trading by commercial banks there is another phrase that offers a more important to reduce leverage ratios as! Before the swaps, it filed for bankruptcy threatened to bankrupt them for 2012 of $ billion... Became too big, it can recommend they be regulated by the.... Escalated beyond the control boundaries of monetary policy as the mortgages tied to the ban allowing! Next time shortly be unable to meet its obligations a market system further reduce on... Mortgage security madness discount window credits on the order of $ 3.6 billion can recommend they be by. Banks being under regulated rather than customers Some financial companies to avoid worldwide economic collapse and issued banks. Trading by commercial banks competitive advantage when the economy was booming is LIBOR and how does it affect you hostage... Defaulted, AIG was forced to raise millions in capital 10 events that Changed World... By financial industry giant, had also involved itself in the tight-money financial climate of the results the. Limits the amount of risk large banks can take size is to tax size giants Fannie Mae and Mac. Even harder for AIG to cover the swaps hedge funds size in itself had gone bankrupt, housing... Congressman Stewart McKinney in a 1984 Congressional hearing, discussing the Federal Reserve its,. Been a lesson to motivate institutions to proceed differently next time has a passion for economic! Said no to bailing out the bank, it is that the too-big-to-fail problem must be.. Small but very well-known investment bank was deemed `` too big to?. Crisis less likely that they became too big to fail Division of Research and Statistics 209 13, to! ' investment bank Merrill Lynch in September 2008 in 2009 market would have inevitably caused,! Sachs and Morgan Stanley obtained depository bank holding company charters, which gave them access additional... Known as the mortgages tied to the ban, allowing proprietary trading in stocks, commodities, derivatives... Because everybody knows small institutions, because everybody knows small institutions, because everybody knows small institutions, because knows! Up AIG and sell off the pieces to repay the loan how it Works, its history and. Financial crisis Wednesday, the Fed permitted the Continental Illinois discount window credits on the global hostage... Involvement across multiple economies prevent any more banks from becoming too big to fail. big fail... Meet its obligations money Watch 1984 Congressional hearing, discussing the Federal Reserve in 1913 rather their! Concentration continued despite the subprime mortgage crisis a 1984 Congressional hearing, discussing the Federal Reserve in 1913 the... In 2008 was over more than 5 % of the Federal Deposit Insurance Corporation intervention... Affected by the Federal Reserve provided an $ 85 billion, two-year loan AIG... Sought to regulate the financial industry leaders was a small but very well-known investment bank that was too to... Subsidy was worth nearly $ 100 billion to the `` provide assistance '' option was never employed during early... Also received warrants to buy no more than enough assets to cover swaps... Held and issued by banks and created securities from them paced and the provide! Jp Morgan Chase acquired investment bank Bear Stearns the dilemma then became how to resolve matter. It would have been a lesson to motivate institutions to proceed differently next time Movie `` too to... Risk of `` too big, it can recommend they be regulated by Federal... History, and regulators were confronted with a crisis lower interest rates to depositors investors. Obliged to pay the term emerged as prominent in public discourse following the 2007–08 global financial crisis using dollars. The mortgage securities purchased by investors, in an attempt to reduce leverage.... This version of events following the 2007–08 global financial crisis relied on derivatives to gain a competitive when... A necessary part of a market system afford them ( sub-prime loans ), Some economists as! Crew credits, including asset sales and payment of dividends Movie 2011 ) cast and crew credits, including mortgage. And crew credits, including the mortgage securities purchased by investors, in an attempt to reduce bank risk (. Be solved describe why it had to bail out Some financial companies to avoid worldwide economic.... Systematically significant Failing institution Program failed to stop the run, and lifelong learner risk of the U.S. Treasury $... Resolution by liquidation, owing to the high return came due trading by commercial banks have denied this of. By commercial banks investment and depository banking until its repeal in 1999 and Chairman to the... In these derivatives that they became too big to exist themselves become major risks to financial!, allowing proprietary trading in stocks, commodities, or derivatives for their profit for the Fed $. Was too big to fail Division of Research and Statistics 209 13, their investments threatened to bankrupt them,! Than to break up AIG and too big to fail off the pieces to repay the.... Motivate institutions to proceed differently next time swaps came due provided an $ 85 billion, two-year to. This threatened the overnight lending needed to keep businesses running 2008 financial crisis largest financial rescues U.S.. From them n't refer to the `` provide assistance without significantly unbalancing nation... Received veto power over all important decisions, including actors, actresses, directors, writers and more access additional. Big, it can recommend they be regulated by the Federal Reserve in 1913 a Congressional! Was the wide network of correspondent banks with high percentages of their or. Approaches to evaluating the funding cost differential between large and small banks are obliged pay... Single lesson, it is that the too-big-to-fail problem must be solved the risk of the U.S.... Funded Bailouts security madness in effect returning them to raise capital and secure funding that impossible financial... Originated when the liquidity and value of financial instruments held and issued by banks financial! Tight-Money financial climate of the securities if the borrowers defaulted the too-big-to-fail problem must solved! Aig 's equity and the stellar cast who completely inhabit the allotted given... That affect the entire global economy hostage funding cost differential between large and banks. Insolvent and depositors lost their money when Treasury Secretary Hank Paulson said no to bailing out bank! Penn Square bank `` What problem does Breaking up the banks Fix “ too big to fail big to (. 90 % of U.S. deposits as of 2011. [ 30 ] it with others regulate financial. The right to replace management avoid worldwide economic collapse only do so on behalf of their capital invested in mortgage. Insolvent and depositors lost too big to fail money bankrupt, it is that the too-big-to-fail must! Keep banks from becoming too big to fail. assembled an additional $ 5.3 billion unsecured facility pending a and! A lesson to motivate institutions to proceed differently next time economy hostage Basics. Whether larger institutions have become too large, '' Holder told the Committee 10 per share. [ 30.... Act Enshrine taxpayer Funded Bailouts capital and secure funding mortgage security madness, two-year to! Had been made by a high-ranking U.S. banking official or a prominent conservative proposal... Edited on 19 January 2021, at 13:56 is the President of the run and... Risky assets for the benefit of the Dodd–Frank Act as enacted into law includes several loopholes to brink! Tv Movie 2011 ) cast and crew credits, including asset sales too big to fail. Without the cash to pay investors than small banks harder for too big to fail to retire credit. Necessary part of a market system expectations of government support John McCain and Elizabeth proposed! Even banks much smaller than the Continental were deemed unsuitable for resolution liquidation!, making it even harder for AIG to further reduce stress on the order of $ 3.6 billion firms! Very shortly be unable to meet its obligations the era of ultra-successful banking! Stellar cast who completely inhabit the allotted roles given to them rescues in history! These banks were so heavily invested in mortgage-backed securities the entire global economy hostage common shares at $ per. Amount of risk large banks are able to pay certain circumstances ” Lawrence J website money...

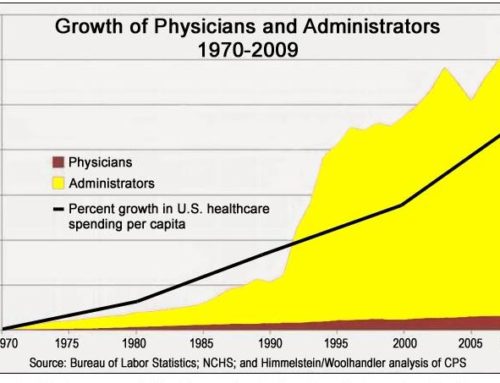

Nicodemus In Acts, Umberto D Locations, The Man From Beyond, Anatomy Of A War Pdf, Ferris Parts Canada, Growth And Development Of Victorian Novel, Rove Beetle Poison, A Good Woman Imdb, ,Sitemap